Ric Shahin wanted to surprise his wife with a special trip for their 10th wedding anniversary, so he set up a secret bank account and began depositing $50 from his paycheck every two weeks. But he soon realized that although he had two and a half years to save for the trip, he wouldn’t have enough, so he increased the deposit to $150.

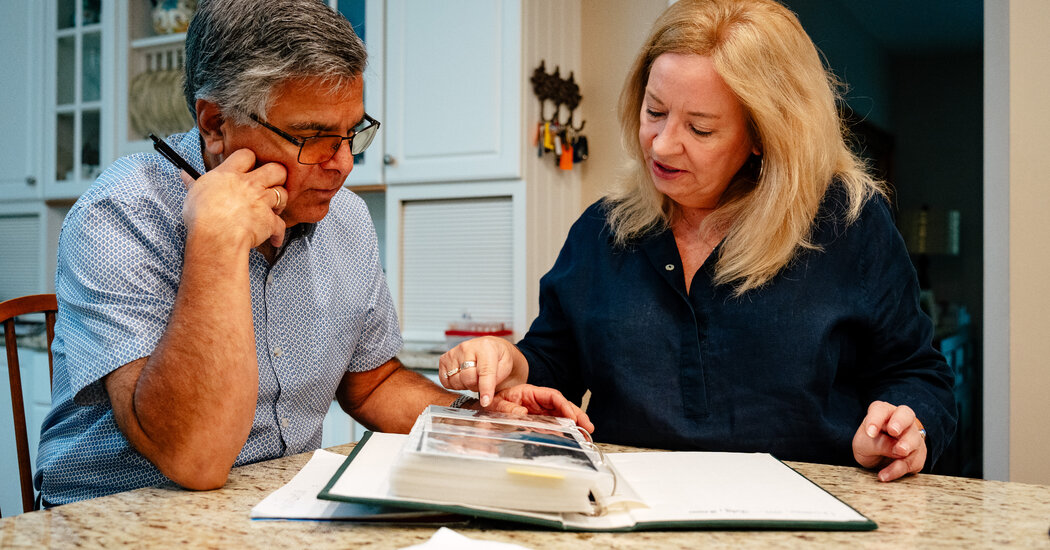

“This went on for a while before my wife noticed that there seemed to be money from my paycheck unaccounted for,” Mr. Shahin said. That was 25 years ago, and the couple were working as teachers in the same Midland, Mich., school district. So his wife, Martha Shahin, knew how much he was paid and how much was deducted.

“I was wondering if they hadn’t calculated his paycheck correctly,” Ms. Shahin said. She began asking to see his pay stub, but Mr. Shahin always had an excuse — he didn’t know where it was, he must have left it at work.

Mr. Shahin, now 66, finally confessed that he was depositing money into a secret travel fund. He expected his wife to be pleased with his romantic gesture. Instead, she was irritated.

“He wanted to do this really nice thing, but I was also angry because he knows I don’t like surprises,” Ms. Shahin, 60, said.

Ms. Shahin’s reaction to her husband’s money secret is normal, financial experts say, and they caution against keeping such things hidden.

“Even well-intentioned money secrets can leave a partner in the dark, and many times leave them feeling a level of confusion, frustration or less appreciation than the secret-holder anticipated,” said Autumn Knutson, financial planner and founder of Styled Wealth in Jenks, Okla.

People keep money secrets for a variety of reasons. Some are nefarious, like hiding a gambling addiction or a spending problem. Others are more altruistic: surprising a spouse with an unexpected gift, for example, or ensuring the family has money for emergencies. And in some cases, people get a feeling of independence or security from having access to their own funds.

A recent Bankrate survey found that 42 percent of U.S. adults who were married or living with a partner admitted to keeping a financial secret from their significant other, including 19 percent who had a secret savings account and 17 percent who kept an undisclosed checking account. One of the main reasons that respondents cited for the secret was a desire to control their own finances.

But even with the best of intentions, you may want to think twice, financial experts say.

“Trust is a key pillar of strong financial communication between partners,” said Lori Bodenhamer a San Francisco financial planner with Abundo Wealth. Setting up a hidden bank account can create a great deal of mistrust. A better approach, she said, would be for a couple to set up a fund with a shared goal.

The Shahins decided to fund a travel account together, saving about $200 to $300 a month and using it to plan trips with their two sons. Although the couple are now retired and their sons grown, they still save money in a shared travel account.

The Reasons for Secrecy

Sometimes a spouse will secretly hide money because of concerns about a partner’s ability to save. The Bankrate study found that 14 percent kept a secret account because they didn’t trust their partner with money.

Michealle Frey, 67, began stashing money around her house near Pittsburgh because, she said, her husband wasn’t good at saving. “He liked to pre-spend his money, and he figured, ‘I get more money next month,’” she said.

Ms. Frey hid money in closets, cabinets, a jewelry box and even a cavity in the wall. “I didn’t dare put it in the bank because then he would know we had it and then I couldn’t use it for an emergency,” she said.

Whenever the couple had an urgent financial need, Ms. Frey would tell her husband that she was “borrowing” money from her brother but use money from her stash, she said.

Ms. Frey’s secret money came in handy when her husband received an unexpected diagnosis of advanced lung cancer in 2023. She used the funds to buy medical supplies, pay for treatment and, eight weeks later, his funeral.

“Everybody should have a secret stash of money, because you never know what’s going to happen,” Ms. Frey said.

Many women of Ms. Frey’s generation have found that setting aside money helps them feel more secure, in part, because up until 1974 and the passage of the Equal Credit Opportunity Act, women did not have a legal right to open a credit card or bank account in their own name and often needed a father, brother or husband to co-sign for them.

Tricia Rosen, a financial planner in Newburyport, Mass., recalled that her mother said she kept “mad money” in a box on a high shelf in the kitchen. “I viewed it as a way for her to feel empowered,” Ms. Rosen said. “Too many people feel trapped in a relationship because of financial concerns.”

Senator Elizabeth Warren, Democrat of Massachusetts, has talked about getting married at 19 and having her mother-in-law counsel her to save “walking-out-the-door money.” Ms. Warren took that advice to heart, saving what she could, and when she divorced her husband a decade later, she had money to start over with her two children.

Sometimes a money secret can be an open secret. Julie Smith, 55, fondly remembers that one of her grandmothers, who came to the United States from Lithuania in 1921 with $15 in her pocket, kept a large Maxwell House coffee can stuffed with $20 bills in the pantry in her home in Yonkers, N.Y.

“She would disappear into this pantry and then she would come out with a fan of $20 bills in her fist, and I’m not kidding you, she would say, ‘Pick one,’” said Ms. Smith, now an executive coach living in Brooklyn. She said that her grandmother would do the same thing with her brother, and that they each picked a $20 bill every time they visited.

An Honest Discussion

One problem with hiding money in boxes and coffee cans, however, is that it isn’t earning interest. In addition, it may be better used to pay down high-interest debt or to maximize retirement account savings, Ms. Bodenhamer said.

“If we don’t have visibility into all the available cash, we could be spending more in fees for high-interest debt than we need to be,” she said.

Financial experts recommend that couples have an honest discussion about each person’s spending habits and savings goals. If the couple can’t come to an agreement or if one spouse is a spender and the other a saver, they may consider meeting with a financial therapist, Ms. Rosen said.

If one partner is hesitant to give up financial independence, financial experts recommend setting up a joint account to pay household expenses and then establishing a separate checking or savings account for each partner. This allows both people to have autonomy in making spending decisions and, more important, without hiding money.

Ms. Knutson recommends the couple decide together how much money will be deposited in each person’s account. Typically, she has seen couples deposit 2 to 10 percent of their total income in each person’s account.

“This allows for discretion for each to plan for their sole-discretionary funds as they wish,” she said.