Federal Reserve officials are keeping a close eye on the job market as they contemplate when and whether they can cut interest rates this year. Friday’s jobs report offered early evidence of the type of moderation that they have been hoping to see.

Average hourly earnings, a measure of wage growth, climbed 3.9 percent in April from a year earlier. That was both cooler than the previous reading and slightly cooler than the 4 percent economists had forecast.

That moderation came as job gains slowed to 175,000 during the month, the unemployment rate ticked up slightly and average weekly hours nudged down. The overall picture was one of a labor market that remains solid but is gradually slowing — exactly what officials at the Fed have been looking for.

Central bankers generally embrace a strong job market: One of their two mandates from Congress is to foster maximum employment. But when inflation is rapid, as it has been since 2021, officials worry that a hot labor market could help to keep price gains elevated. If employers are competing for workers and paying more, they are likely to also try to charge more, the theory goes. And workers who are earning slightly bigger paychecks may have the wherewithal to pay more without pulling back.

“The more jobs reports you get like this,” then “the more confident we can be that the economy is not overheating,” Austan Goolsbee, the president of the Federal Reserve Bank of Chicago, said in a Bloomberg Television interview. Mr. Goolsbee does not vote on monetary policy this year.

At the Fed’s policy meeting this week, officials kept interest rates at 5.3 percent, the highest level in more than two decades. The central bank started 2024 expecting to cut rates several times, but those plans have been delayed by surprisingly stubborn inflation.

Investors now expect two rate cuts before the end of the year. Investors have generally lowered the odds of rate cuts over the past few months, but they saw a slightly bigger chance that the Fed will cut rates substantially following Friday’s employment report. Stock indexes picked up after the report, as investors welcomed the more moderate data.

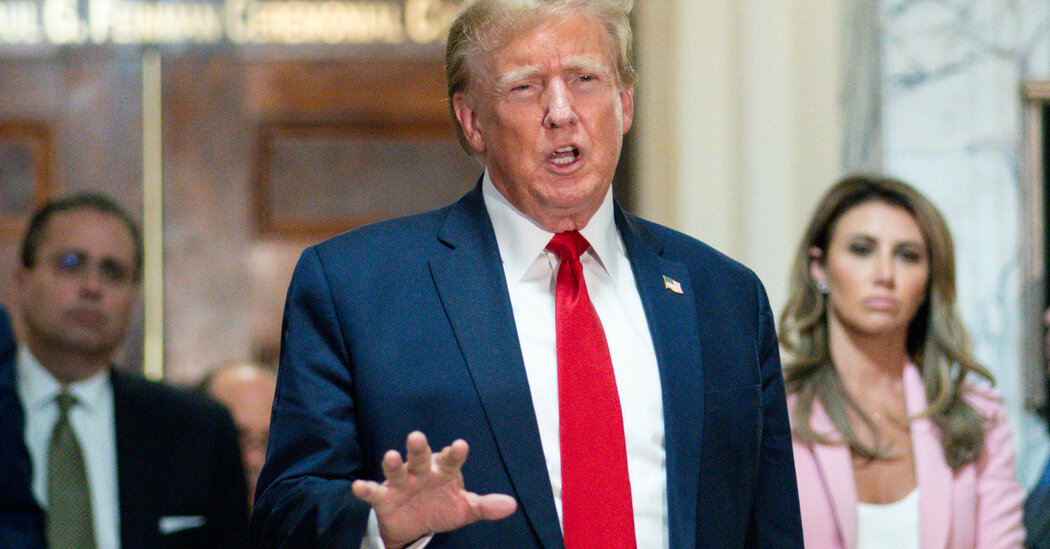

While inflation is the main thing determining when and how much borrowing costs can come down, Jerome H. Powell, the chair of the Federal Reserve, made it clear this week that central bankers are also watching what happens with hiring and pay.

Mr. Powell emphasized repeatedly that the Fed did not specifically target wage growth when setting policy, but he also suggested that pay gains might need to slow further for inflation to come down sufficiently and in a lasting way — which means that Friday’s numbers could be a welcome development.

“We don’t target wages; we target price inflation,” he said. When it comes to cooling the economy, he said, “part of that will probably be having wage increases move down incrementally toward levels that are more sustainable.”

Mr. Powell laid out several possibilities for what could come next with rates, and the job market is a factor in some scenarios.

A combination of persistent inflation and continuing strength in the labor market could prompt the Fed to leave rates unchanged for longer, he said. But if inflation begins to cool again, that would pave the way for rate cuts, Mr. Powell said. So, too, could evidence that the job market is cooling unexpectedly.

Friday’s small tick up in unemployment was probably not enough to meet that standard. Mr. Powell suggested this week that it would take more than a small jump in unemployment for the Fed to feel that the job market was struggling enough to merit lower rates.

“It would have to be meaningful and get our attention and lead us to think that the labor market was really significantly weakening for us to want to react to it,” he said, adding that an increase of a couple of tenths of a percentage point in the unemployment rate would probably not meet that standard. “It would be a broader thing,” he said.

Michelle Bowman, a Fed governor who tends to favor higher rates more than her colleagues, emphasized after the report that the job market was still strong.

“Although we had seen signs of the labor market coming into better balance, recent employment reports show a continued tight labor market,” Ms. Bowman said, noting that the unemployment remained below 4 percent and that “the number of job openings relative to unemployed workers is still above its prepandemic level.”

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/en-IN/register?ref=UM6SMJM3

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.